6 Reasons Why Americans are Ditching Their Traditional Investments for Roots

For a long time, “investing” meant playing the stock market or cashing out on maturing bonds that your uncle bought you when you were born. Luckily, that’s no longer the case.

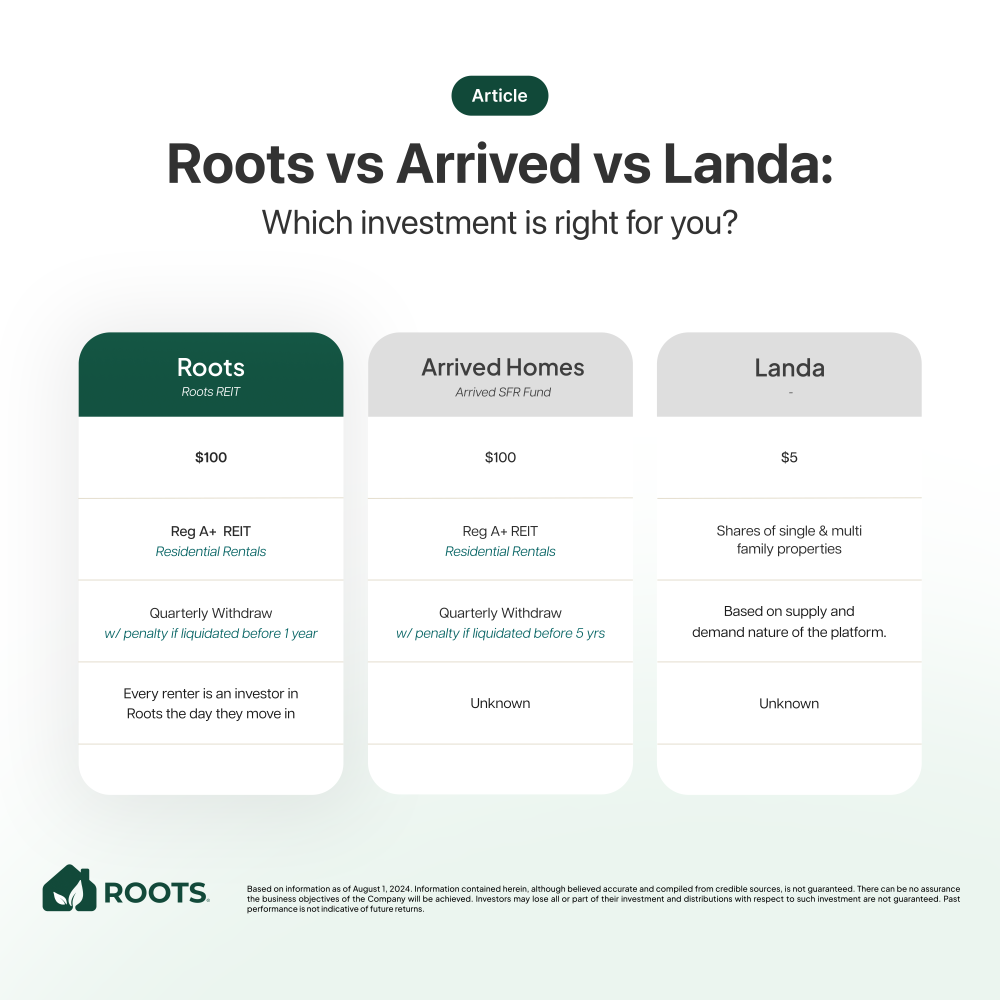

Today, you can invest in something less risky than stocks and more profitable than bonds: real estate investment trusts (REITs). 50% of American households have invested their money into REITs, and Roots has emerged as a leader in the market. Here’s why:

Low Entry Point

.

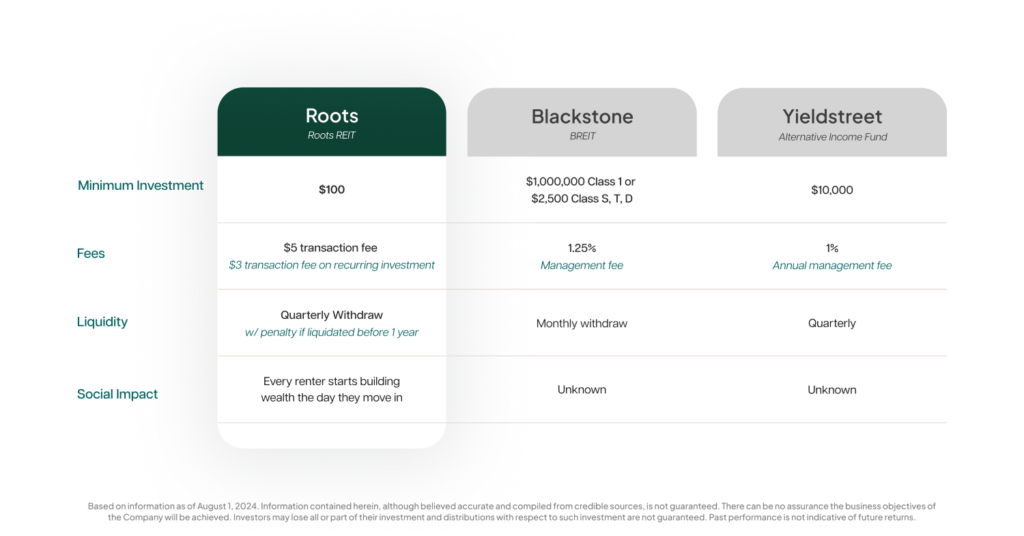

Unlike many other investing platforms, you don't need to be some ex-Wall Street bigshot to invest with Roots. Roots has created a real estate investing platform built for EVERYONE. For as little as $100, you can invest in a portfolio of residential real estate, and whether you want to invest $100 or $100,000, Roots offers every investor the same dedicated customer service the fund has become known for since its inception.

Low Fees

Roots has low fees, with only a $5 transaction fee on each normal investment or a $3 transaction fee on any recurring investment.

Liquidation

Today, fewer than half of Americans (44%) say they can afford to pull a $1,000 emergency expense from their savings. The reality of life is that things like medical bills, unplanned major life events, unexpected job loss/taxes, and a long list of other unwanted circumstances arise at times when they are most inconvenient. With Roots, investors can liquidate their investments every quarter. If you liquidate before one year on any investment, there is a 6% early cash out fee, but after the one-year mark, there is no liquidation fee, a rarity in the world of real estate investing.

Roots Helps Others

In an economy where one social media post can have the power to drive a stock up or down based on speculation, and publicly traded companies cut entire departments to keep their shareholders happy, something is refreshing about compassionate capitalism.

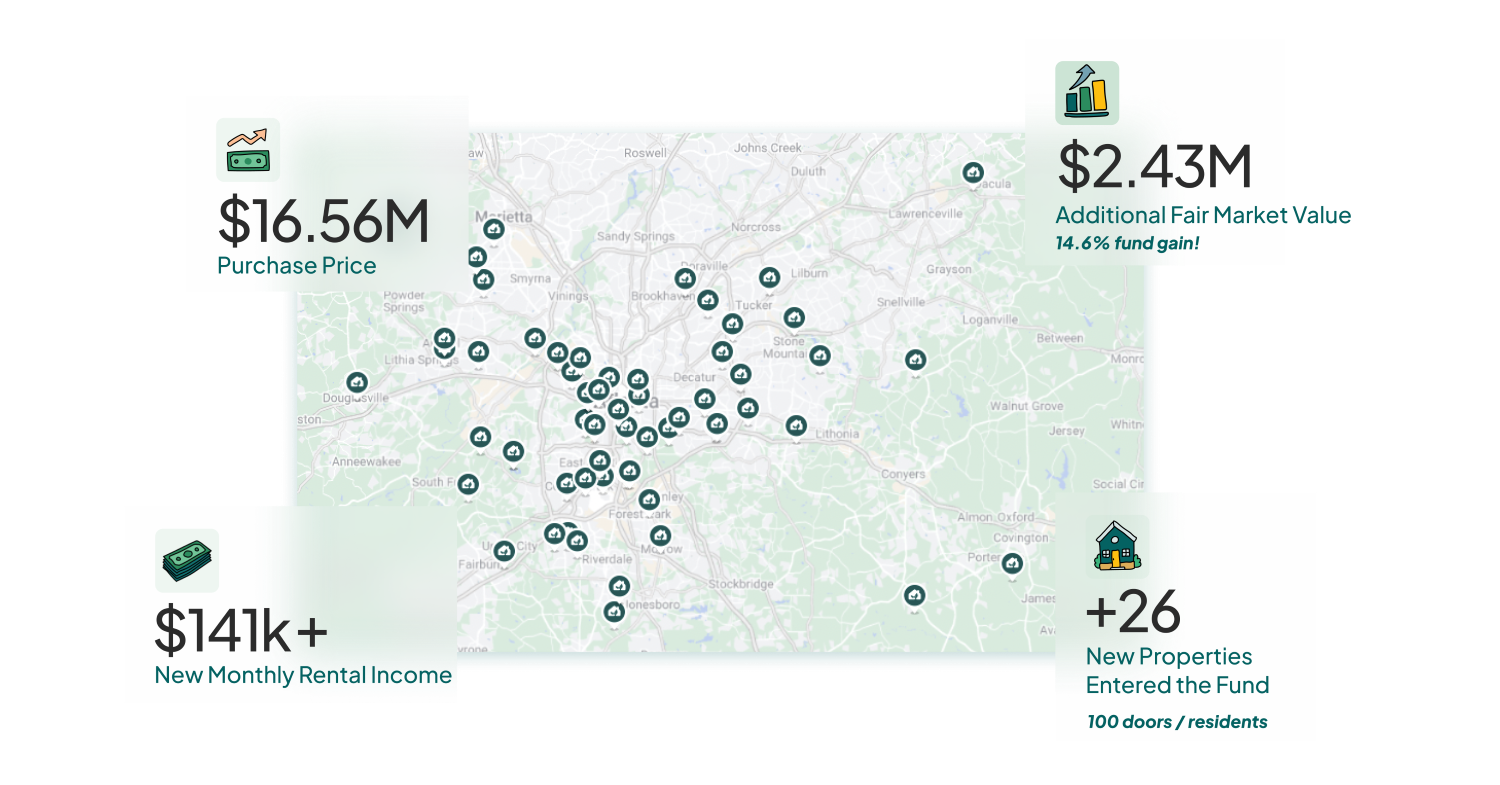

Roots has a unique model in which the renters in Roots' properties get invested in the fund for being good renters, aligning incentives of everyone involved. By paying rent on time, taking care of their property, and being a good neighbor, Roots renters can receive quarterly rebates that get invested in their name in the fund. This model has led to less property vacancy, lower turnover costs, and historically high returns for the fund's investors, all while giving people from all walks of life the opportunity to build wealth while renting.

Hedging Against Stocks

Experts say that for every 1% increase in interest rates, the S&P 500 index (which measures the stocks of the 500 largest companies listed on stock exchanges in the United States) loses 3-6% of its value. When rates are high, companies have to pay more to borrow money, consumer spending goes down, and corporate costs go up. Consequently, companies' valuations vary depending on how susceptible they are to these hurdles. When rates go up, stocks usually go down.

With new-age investment avenues, investors are much more protected from tsunamis caused by high interest rates. REITs are historically a perfect hedge against inflation. As the general price level rises, the value of tangible assets like property tends to increase. Investing in stocks is still smart, but with the volatility we've seen from stocks throughout history, it's best to have all your bases covered.

Transferring IRAs and 401ks

Have an IRA leftover from your employer that is no longer being matched, or one that is not returning the way you’d like? Investors are transferring part or all of their retirement accounts to Roots. Some are even starting new ones for the tax advantages with a residential real estate investment. Investors get the added benefit of Roots distributions getting reinvested plus a nice hedge against the stock market since IRAs are usually pegged to securities. With much lower fees than a traditional money manager “managing” the IRA and the added benefit of keeping the IRA tax benefits, this is a no brainer for a lot of folks.

Here's how it works

1. Invest with Roots: Start with as little as $100 and become part of a community that's reshaping real estate.

2. Roots Does the Heavy Lifting: We acquire and manage the properties, ensuring they are well-maintained and occupied by responsible renters.

3. Renters Benefit: Renters that live in Roots homes build equity by paying rent on time and caring for their homes like they own them. This unique approach not only empowers them but also strengthens the community.

4. Everyone Wins: By lowering turnover costs, minimizing vacancies, and creating solid returns, we aim to provide both investors and renters with significant growth.

Join thousands across America who are investing with Roots: With over $42 million already invested, now is your chance to grow your wealth while helping the renters grow theirs. Invest with Roots today and be part of a movement that’s making a real difference

Start Investing

You may be interested in